iowa state income tax calculator 2019

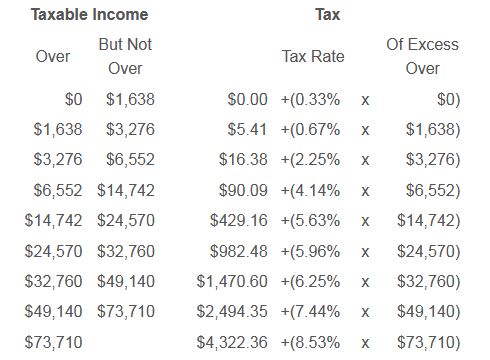

The following items must be included when determining if you are eligible for the 9000 exemption. The states income tax rates range from 033 to 853.

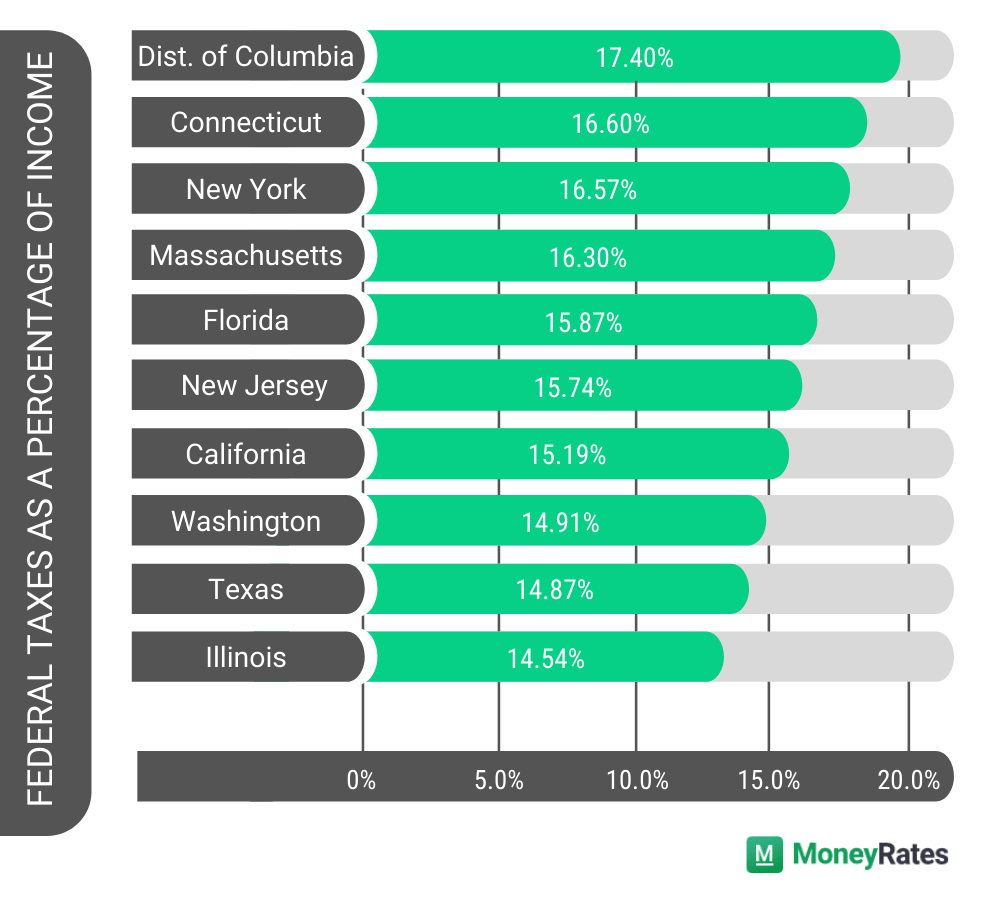

Which States Pay The Most Federal Taxes Moneyrates

You can produce a.

. Fields notated with are required. SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. The Iowa State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Iowa State Tax CalculatorWe also provide State Tax.

Iowa is used as the default State for for this combined Federal and State tax calculation you can choose an alternate State using the 2019 State and Federal Tax calculator. 15 Tax Calculators 15 Tax Calculators. The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and.

You can produce a. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040.

The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa. Use our Withholding Calculatorto review your W-4. Iowa is used as the default State for for this combined Federal and State tax calculation you can choose an alternate State using the 2019 State and Federal Tax calculator.

Multiply federal adjusted gross. If you would like to update your Iowa withholding. Income included to determine exemption.

Paycheck calculators by state Iowa state income tax Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. You can produce a. 2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax.

2021 Tax Year Return. Tax Credits Checkoff Contributions Instruction Year 2019 View tax tables for all filing statuses. Federal or IRS Taxes Are Listed.

Alternate Tax Calculation You may owe less tax by completing the worksheet below to. The Iowa expanded instructions for lines 14 and 18 of the IA 1040 set forth the Departments guidance for the correct reporting of these amounts. GovConnectIowa is the State of Iowas user-friendly self-service portal to register or renew certain business licenses and permits file tax returns and reports make payments and more.

The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa. The following tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances living in Iowa. How to calculate Federal Tax based on your Annual Income.

The Iowa State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Iowa State Tax Calculator. The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. We also provide State Tax.

Iowa Department Of Revenue Issues Key Guidance On Dpad Like Kind Exchange And 2019 Income Tax Brackets Center For Agricultural Law And Taxation

When Are State Tax Returns Due In Iowa Kiplinger

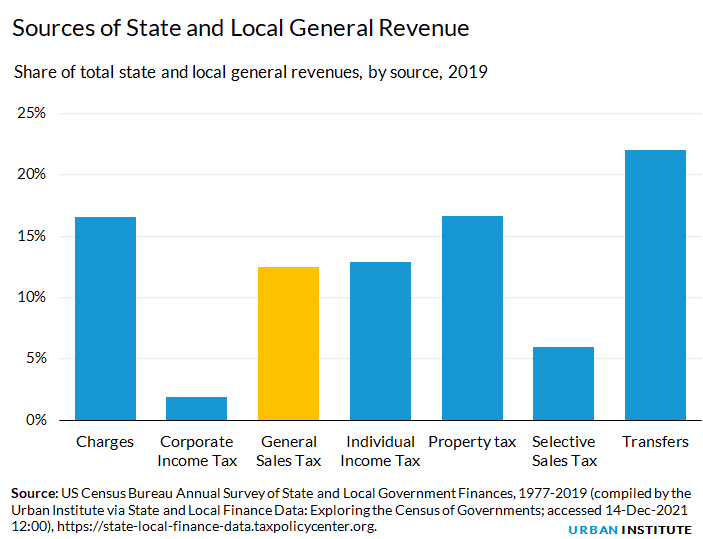

Individual Income Taxes Urban Institute

Fuel Taxes In The United States Wikipedia

Will My State Refund Be Delayed In 2020

2019 Tax Brackets Things To Know Credit Karma

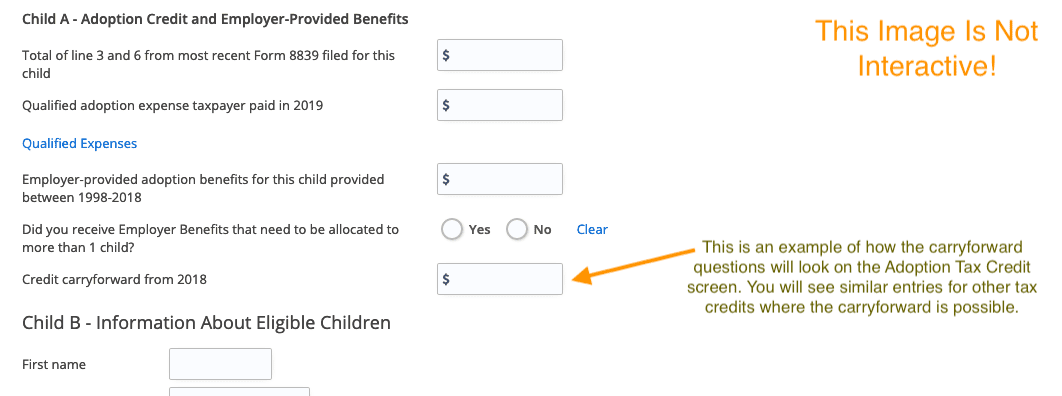

Federal Tax Credits You May Qualify For On Your Tax Return

How Do State And Local Individual Income Taxes Work Tax Policy Center

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

General Sales Taxes And Gross Receipts Taxes Urban Institute

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Iowa Sales Tax Guide And Calculator 2022 Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

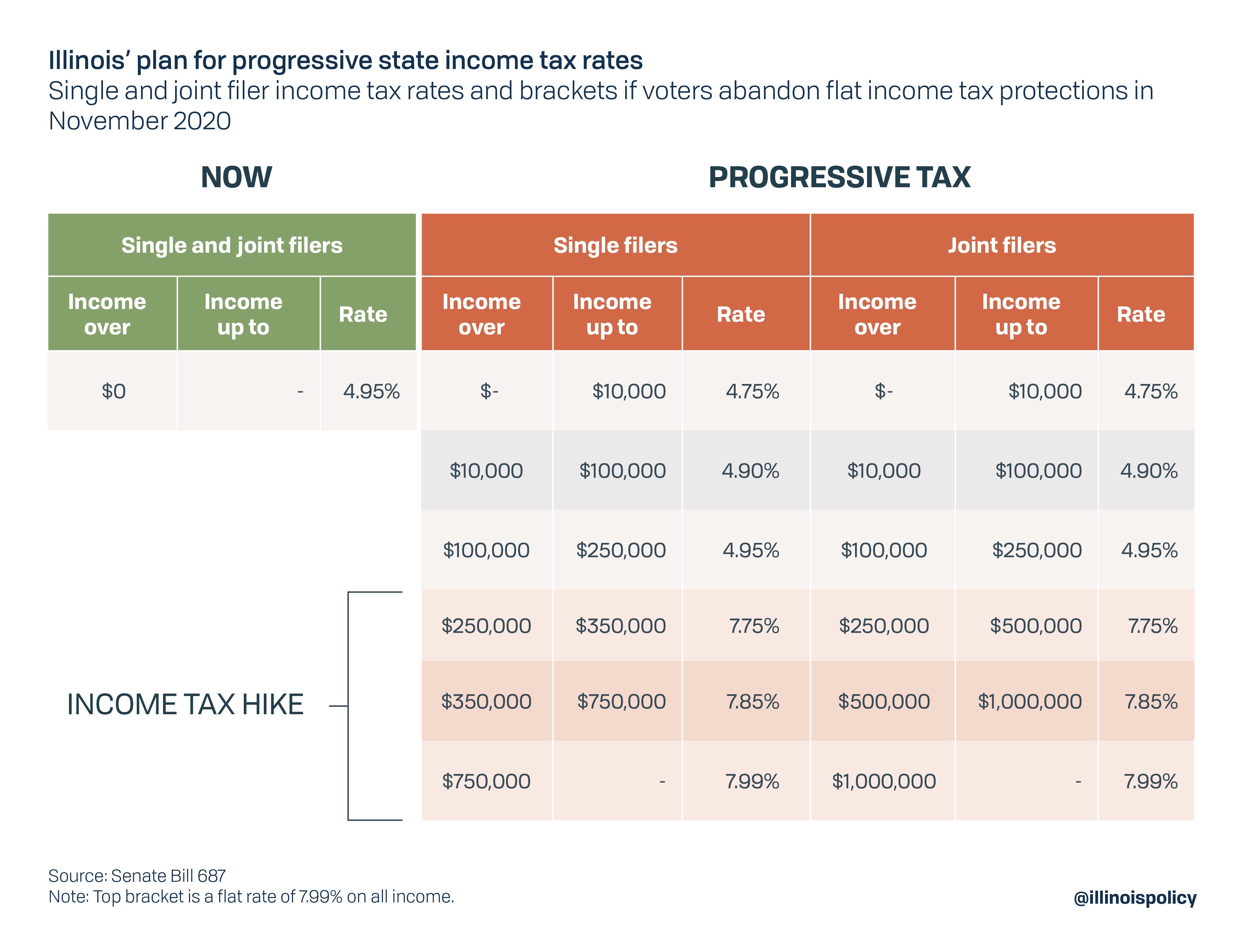

With Voters Set To Decide On Progressive Income Tax Illinois Wealth Flight Among Worst In The Nation

Irs State Tax Calculator 2005 2022

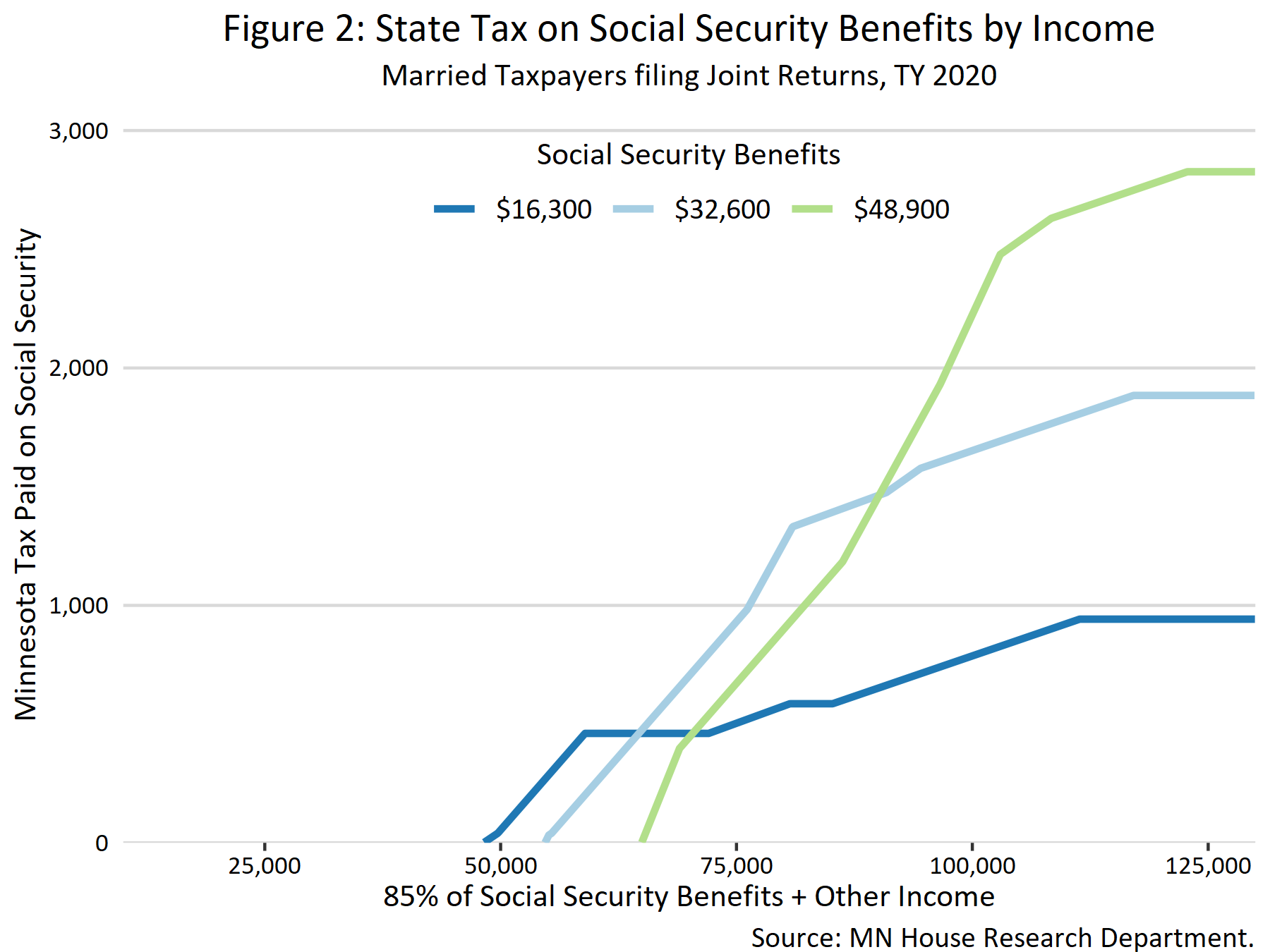

Taxation Of Social Security Benefits Mn House Research

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)