how do business loans work in canada

How Do Business Loans Work. Full-time students can get up to 60 percent of their education funded with a federal student loan whereas part-time students can receive up to 10000.

Loans Credit City National Bank

In order to be categorized.

. Government-Guaranteed Loans to Support the Growth of Your Business. If you are interested in a business loan for renovation. How do business loans work.

Here at Smarter Loans we work with a plethora of business loan providers that specialize in catering to the needs of renovations. Find out everything you need to know to apply for secure your business loan successfully. Unsecured Business Loans are usually monetary loans that are not secured by any business or personal asset.

Business credit cards or personal loans are good for startup capital while day-to-day expense needs are best served by a. Even within the same lender the types of loans available vary. Loans Canada and its partners will never ask you for an upfront fee deposit or insurance payments on a loan.

A qualified business owner. Here the lender is counting on your business to be able to. BDC Canadas government owned bank for small business and entrepreneurs offers an easy 3-step process for getting a.

The main reason is that if the lender can match the loan to the businesss need it reduces the risk on both parties. This is a loan specifically for small businesses that can be used for a variety. The Small Business Loan.

Applying for a business loan is easier than ever. Discover how to get business loans in Canada. What is a small business loan.

Small businesses and start-ups with less than 10 million in gross revenue can apply for financing for land improvements renovations and equipment through the Canada small. Startup business loans from Business Development Bank of Canada BDC The BDC is a Crown corporation and its sole shareholder is the Government of Canada. Canadian Small Business Financing Program CSBFP The Canadian Small Business Financing Program is developed by the government of Canada and is offered through banks.

A business owner or associate borrows money from a lender on behalf of the business. Small businesses looking to purchase or improve their assets for new or expanded operations could benefit from. Business loans provide your company with funding for any business-related expenses like growth filling in cash flow gaps and covering.

A small business loan is a personal loan you can take out to cover expenses of opening and operating your small business. How do business loans work. Loans Canada Business Loan.

Canada Small Business Financing Program CSBFP Most Canadian small businesses with under 10 million in revenue are eligible to apply. Business Loans work like a personal loan. The most common types of government loans for businesses in Canada are.

Loans Canada is not a mortgage broker and does not arrange.

Financing Profile Borrowers Under The Canada Small Business Financing Program Sme Research And Statistics

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

Loan Vs Line Of Credit What S The Difference

Newcomer Business Owners Entrepreneurs In Canada Rbc

The Small Business Owner S Guide To Getting An Sba Loan Businessnewsdaily Com

Common Types Of Loans In Canada And How They Work Nerdwallet

Our Companies Rocket Companies

How To Secure Small Business Financing In Canada Opstart

Commercial Secure And Unsecure Loans Priority Lending Commerical Equipment Financing In Pittsburgh Pennsylvania Brampton Ontario

![]()

Startup Business Loans Loans Canada

The Average Business Loan Interest Rates In 2022 Nav

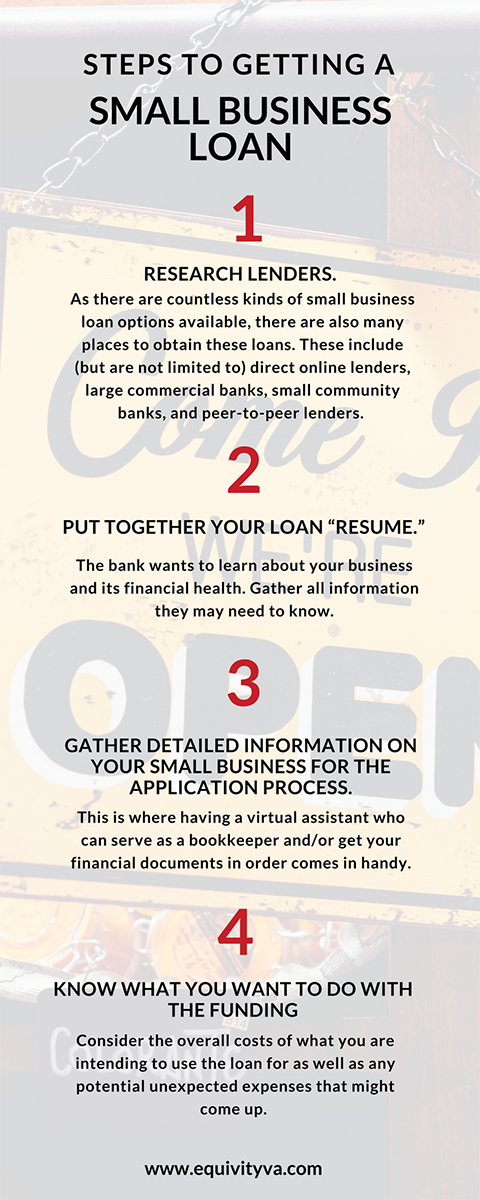

Everything You Need To Know About Small Business Loans Infographic Business 2 Community

How To Get A Business Loan In Canada Bdc Ca

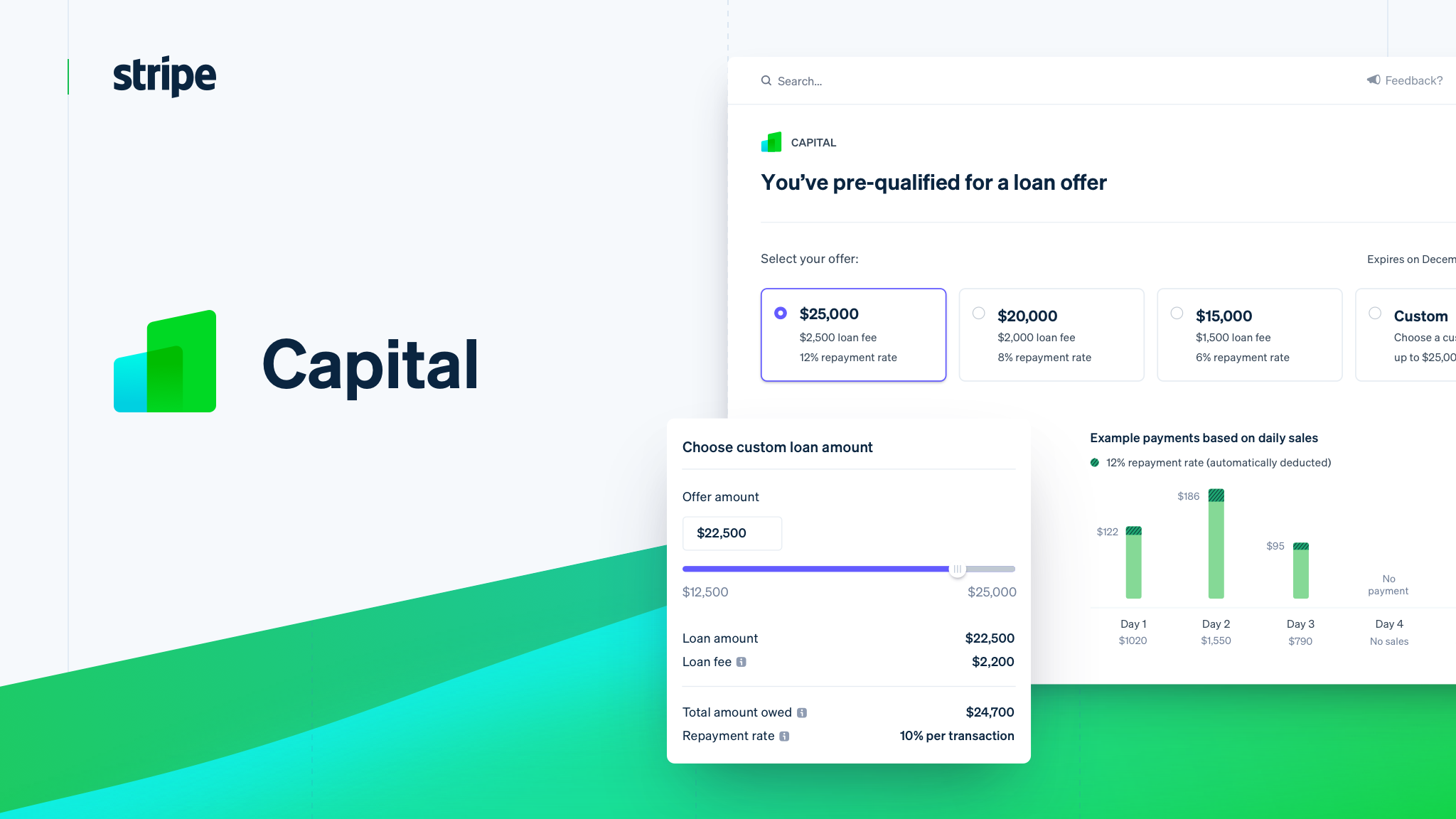

Stripe Capital Loans For Small Businesses Startups And More

Get A Small Business Loan Online L Paypal Us

Small Business Loans For Quickbooks Customers Quickbooks Capital

Small Business Loan Requirements Business Org

Long Term Working Capital Loans And Financing Priority Lending Commerical Equipment Financing In Pittsburgh Pennsylvania Brampton Ontario

Finance Small Business Vehicle Lending Td Canada Trust

Business Loans In Canada Requirements And How To Apply Businessfinancedaily